- 714.29 KB

- 2022-04-29 14:10:36 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

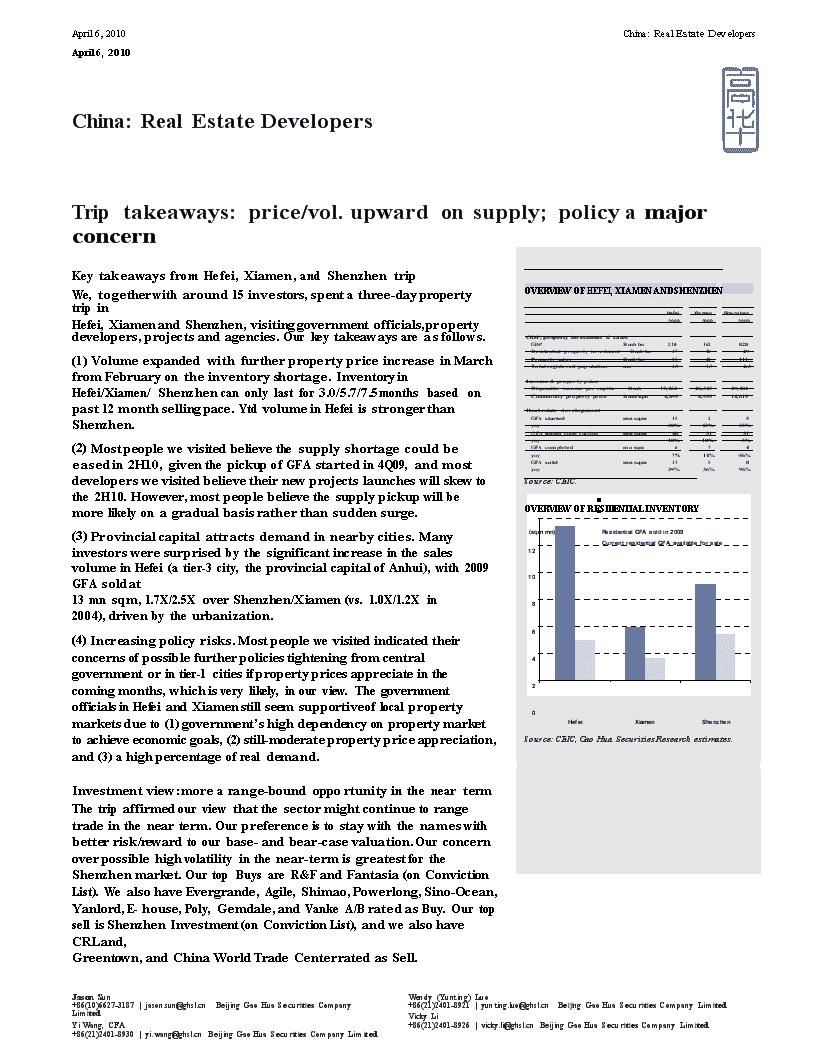

'April6,2010China:RealEstateDevelopersApril6,2010China:RealEstateDevelopersTriptakeaways:price/vol.upwardonsupply;policyamajorconcernApril6,2010China:RealEstateDevelopersKeytakeawaysfromHefei,Xiamen,andShenzhentripWe,togetherwitharound15investors,spentathree-daypropertytripinHefei,XiamenandShenzhen,visitinggovernmentofficials,propertyOVERVIEWOFHEFEI,XIAMENANDSHENZHENHefeiXiamenShenzhen200920092009April6,2010China:RealEstateDevelopersdevelopers,projectsandagencies.Ourkeytakeawaysareasfollows.(1)VolumeexpandedwithfurtherpropertypriceincreaseinMarchfromFebruaryontheinventoryshortage.InventoryinHefei/Xiamen/Shenzhencanonlylastfor3.0/5.7/7.5monthsbasedonpast12monthsellingpace.YtdvolumeinHefeiisstrongerthanShenzhen.(2)Mostpeoplewevisitedbelievethesupplyshortagecouldbeeasedin2H10,giventhepickupofGFAstartedin4Q09,andmostdeveloperswevisitedbelievetheirnewprojectslauncheswillskewtothe2H10.However,mostpeoplebelievethesupplypickupwillbemorelikelyonagradualbasisratherthansuddensurge.(3)Provincialcapitalattractsdemandinnearbycities.ManyinvestorsweresurprisedbythesignificantincreaseinthesalesvolumeinHefei(atier-3city,theprovincialcapitalofAnhui),with2009GFAsoldat13mnsqm,1.7X/2.5XoverShenzhen/Xiamen(vs.1.0X/1.2Xin2004),drivenbytheurbanization.(4)Increasingpolicyrisks.Mostpeoplewevisitedindicatedtheirconcernsofpossiblefurtherpoliciestighteningfromcentralgovernmentorintier-1citiesifpropertypricesappreciateinthecomingmonths,whichisverylikely,inourview.ThegovernmentofficialsinHefeiandXiamenstillseemsupportiveoflocalpropertymarketsdueto(1)government’shighdependencyonpropertymarkettoachieveeconomicgoals,(2)still-moderatepropertypriceappreciation,and(3)ahighpercentageofrealdemand.Investmentview:morearange-boundopportunityintheneartermThetripaffirmedourviewthatthesectormightcontinuetorangetradeinthenearterm.Ourpreferenceistostaywiththenameswithbetterrisk/rewardtoourbase-andbear-casevaluation.Ourconcernoverpossiblehighvolatilityinthenear-termisgreatestfortheShenzhenmarket.OurtopBuysareR&FandFantasia(onConvictionList).WealsohaveEvergrande,Agile,Shimao,Powerlong,Sino-Ocean,Yanlord,E-house,Poly,Gemdale,andVankeA/BratedasBuy.OurtopsellisShenzhenInvestment(onConvictionList),andwealsohaveCRLand,Greentown,andChinaWorldTradeCenterratedasSell.GDP,propertyinvestment&salesGDPRmbbn210162820ResidentialpropertyinvestmentRmbbn471829PropertysalesRmbbn5542111Totalregisteredpopulationmn4.91.72.3Income&propertypriceDisposableincomepercapitaRmb17,46226,34329,402CommoditypropertypriceRmb/sqm4,0958,93514,615RealestatedevelopmentGFAstartedmnsqm1525yoy30%-43%-35%GFAunderconstructionmnsqm483131yoy18%-10%-5%GFAcompletedmnsqm674yoy7%14%-36%GFAsoldmnsqm1358yoy39%36%96%Source:CEIC.OVERVIEWOFRESIDENTIALINVENTORY(sqmmn)ResidentialGFAsoldin2009CurrentresidentialGFAavailableforsale121086420HefeiXiamenShenzhenSource:CEIC,GaoHuaSecuritiesResearchestimates.April6,2010China:RealEstateDevelopersApril6,2010China:RealEstateDevelopersJasonSun+86(10)6627-3187|jason.sun@ghsl.cnBeijingGaoHuaSecuritiesCompanyLimitedYiWang,CFA+86(21)2401-8930|yi.wang@ghsl.cnBeijingGaoHuaSecuritiesCompanyLimitedWendy(Yunting)Luo+86(21)2401-8921|yunting.luo@ghsl.cnBeijingGaoHuaSecuritiesCompanyLimitedVickyLi+86(21)2401-8926|vicky.li@ghsl.cnBeijingGaoHuaSecuritiesCompanyLimited

April6,2010China:RealEstateDevelopersBeijingGaoHuaSecuritiesCompanyLimitedanditsaffiliatesdoandseektodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.Foranalystcertification,seetheendofthetext.OtherimportantdisclosuresfollowtheRegACcertification,orcontactyourinvestmentrepresentative.April6,2010China:RealEstateDevelopersBeijingGaoHuaSecuritiesCompanyLimitedInvestmentResearchGaoHuaSecuritiesInvestmentResearch1

April6,2010China:RealEstateDevelopersHefei—provincialcapitaltoattracthousingdemandinthenearbycities·Hefei,theprovincialcapitalofAnhuiprovince,islocatedinthecentralChinaareaandhasatotalregisteredpopulationof5mn.·Wehaveseenstrongpropertyprice/volumeexpansionintheHefeipropertymarket.Hefei’stotalGFAsoldin2009reached13mnsqm,whichis1.7X/2.5XoverShenzhen/Xiamenvs.1.0X/1.2Xin2004.Thepropertymarketperformanceinearly2010isalsoencouraging,withJanuary-FebruaryGFAsoldat2.4mnsqm,up114%yoy,muchbetterthantheperformanceinXiamenandShenzhen.·Localcitygovernorsaresupportiveofthelocalpropertymarket.ThelocalgovernorwevisitedbelievesthepropertymarketiscrucialforHefei’sdevelopment(HefeiistargetingGDPatRmb600bnin2015,implyingnominalGDPCGARat20%during2009-2015),andhebelievesthecurrentpropertymarketinHefeiishealthy,giventheactivepropertymarketwithsteadyincreasingpropertyprice,moreaffordablepricesthantier1cities,andahighpercentageofrealunderlyingdemand.·WeunderstandinventoryinHefeiislow,whichmightpushuppropertypricesfurtherincomingmonths.AsofFebruary2010,theresidentialGFAavailableforsaleinHefeiisapproximately3.0mnsqm,whichisonlythreemonths’salesbasedonlast12months’sellingpace.Thecomingnewsupplycouldbehigherthanthatintier-1citiesduetofewerlandsupplyconstraintsinHefei,andmostdeveloperswevisitedstillplantoincreasepricesfortheirupcomingnewlaunches.·Thestrongvolumeperformanceismainlydrivenbyunderlyingdemandduringtheurbanizationprocesswithmorepeopleatlowercities/countiesmovingtoprovincialcapitalsforbetterlivingconditions,abetterhealthcaresystem,andabettereducationsystem.AccordingtoHefeiStatisticsBureau,amongallthehomebuyersin2009,48%camefromlocalresidentinHefei,42%camefromothercities/countieswithinAnhuiprovinceotherthanHefei,andtheother10%camefromotherprovinces.Xiamen-—volumedropin2010ispossiblebutmodest;propertypricesmayincreasefurther·XiamenSpecialEconomicZoneisamoredevelopedcitythanHefei,withanurbanizationratioof68%.Itisthesecond-largestcityinFujianprovincefollowingFuzhoucity.·ThepropertymarketinXiamenismoredrivenbythedemandwithinFujianprovince,similartoHefei.Accordingtolocalstatistics,in2009approximately40%ofbuyersarelocalresidents,50%arefromothercitieswithinFujianprovince,andtheother10%arefromotherprovinces.·AlocalgovernorestimatestotalGFAtobesoldin2010atapproximately3.5mnsqm,downapproximately10%yoyfrom2009,andhebelievespropertypricestherewillcontinuetheupwardtrendduetosupplyconstraintsandmoreinvestmentdemand.·Thelocalgovernorindicatesthelocalgovernment’sfocusshouldbeonaffordablehousingandshouldnotaggressively“hornin”onthedevelopmentofGaoHuaSecuritiesInvestmentResearch6

April6,2010China:RealEstateDeveloperstheprivatehousingmarket.GaoHuaSecuritiesInvestmentResearch6

April6,2010China:RealEstateDevelopers·Adeveloperwevisitedindicatedpropertypricesmaycontinuetoriseinthenextfewmonthsduetosupplyconstraints.CurrentlythedeveloperhasnoGFAavailableforsale,hasbeenspeedinguptheconstructionprocess,andexpectstwonewprojects(acquiredin2H09)tobelaunchedafterJune2010.Shenzhen—relativelyweakprice/volumeperformance;policyriskrelativelyhigh·ShenzhenisoneofthemostdevelopedcitiesinChinawithresidentpopulationatapproximately8.8mn.·TheprimarypropertymarketinShenzhenhasbeenshrinkinginthepastyearswithaverageresidentialGFAsoldatapproximately5.4mnsqmduring2008-2009from6.3mnsqmduring2005-2006duetoahighurbanizationratio(almost100%)andlimitedlandsupply.In2009,thetransactionvolumeinthesecondarymarketcontributed65%ofthetotaltransactionvolumeinShenzhen,thehighestinChina.·InlaterMarch2010,thetransactionprice/volumeperformanceinShenzhenalsoreboundedbutstilllaggedtheothermajor14citieswetracked,withJanuary-March2010volumedown58%vs.2009andup19%vs.2008comparedwitha15-cityaveragedown23%vs.2009andup32%vs.2008.TheaveragesellingpriceinMarchislargelyflattishvs.thebeginningof2010.·Mostpeoplewevisitedbelievethepolicyrisksinthosetier-1citiessuchasShenzhenandBeijingshouldbehigherthaninsmallertiercitiesduetolessdependencyonthepropertymarketandmorepressurefromsurgingpropertyprices.AdeveloperwevisitedinShenzhenindicatedthepossibilityofpropertytaxesinselectivecitiesifpropertypricescontinuetorisesignificantly.·Duetorelativelylowinventory(3.5mnsqmGFAavailableforsaleasofMarch2010)andlimitedlandsupply,wethinkthechanceforasignificantpropertypricedropinShenzhenislowinthenearterm,butwebelievetheaforesaidweakvolumeperformancemaynegativelyaffectcontractsalesperformancein2010fordeveloperswithhighexposuretoShenzhen.TheShenzhengovernmentplanstofocusonthelandrenewalandreconstructiontoresolvethelandconstraints.GaoHuaSecuritiesInvestmentResearch6

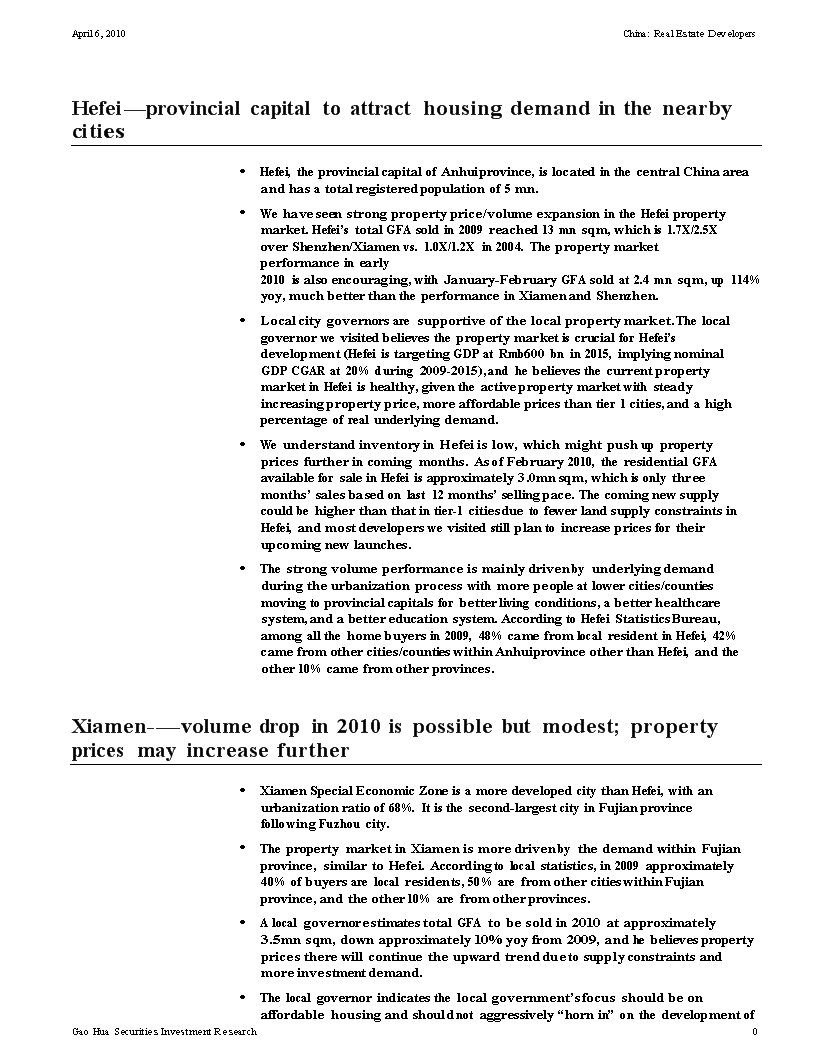

April6,2010China:RealEstateDevelopersExhibit1:Chinadevelopers’valuationcomparisonCompanyTickerMktCap(US$bn)RatingPriceasof12mthPotentialPriceupside/2/Apr/10targetdownsideEnd-10EexistingSharepriceNAVper(disc)/premsharetoEnd-10E(LCY)NAV(%)FDCoreP/E(x)EPSGrowth(%)P/B(x)Dividendyield(%)Bear-casevaluationWorst-casevaluation0809E10E11E09E-11E0809E10E11E0809E10E11EHongKongListedAgileProperty3383.HK5.3Buy10.98(HK$)12.8817%16.10(32)8.204.566.718.112.810.431%2.82.62.21.93.00.61.62.4ChinaOverseasLand0688.HK18.8Neutral17.92(HK$)17.39-3%19.32(7)12.118.7635.222.516.312.833%4.33.53.02.50.71.11.31.6ChinaResourcesLand1109.HK11.1Sell17.18(HK$)16.12-6%20.15(15)11.067.8042.727.620.216.629%2.42.32.11.90.71.41.21.5CountryGarden2007.HK5.9Neutral2.83(HK$)3.1511%3.94(28)2.011.0929.819.815.912.027%2.22.01.81.61.21.81.31.7Evergrande3333.HK6.4Buy3.31(HK$)4.1525%5.93(44)3.211.8215.799.65.64.9347%0.93.72.31.61.70.21.82.0Fantasia1777.HK1.1Buy*1.80(HK$)2.6346%3.75(52)2.101.6624.722.55.55.3105%1.72.11.61.30.11.43.73.8Franshion0817.HK2.9Neutral2.64(HK$)3.0114%3.34(21)2.311.6520.723.117.422.12%1.61.51.41.31.00.90.90.7GreentownChina3900.HK2.5Sell11.52(HK$)10.62-8%17.69(35)7.364.1129.410.99.98.612%1.91.71.41.22.81.91.01.2GuangzhouR&FProperty2777.HK5.5Buy*13.30(HK$)16.0220%22.89(42)9.896.2118.815.610.48.336%2.62.31.91.72.43.03.94.8KWG1813.HK2.2Neutral5.83(HK$)5.891%8.42(31)3.922.3134.722.313.412.035%1.61.41.31.20.61.00.40.4Powerlong1238.HK1.3Buy2.43(HK$)2.9622%4.94(51)2.862.0229.37.36.45.712%3.21.30.90.80.03.73.84.7ShanghaiForteLand2337.HK0.8Neutral2.48(HK$)2.501%3.57(30)1.900.9215.912.74.67.132%1.10.90.80.70.92.74.34.2ShenzhenInvestment0604.HK1.3Sell*2.94(HK$)2.83-4%4.71(38)2.181.2514.112.210.09.513%0.90.80.80.73.71.62.04.2ShimaoProperty0813.HK6.7Buy14.72(HK$)16.3511%20.43(28)9.786.3846.415.412.19.824%2.32.01.71.40.90.60.81.0ShuiOnLand0272.HK2.8Neutral4.11(HK$)4.6313%6.62(38)4.182.327.916.232.619.8-10%0.90.90.80.81.71.00.30.5SinoOcean3377.HK5.1Buy6.99(HK$)8.4521%10.56(34)6.203.7620.131.212.911.563%1.71.51.31.21.51.21.51.7SOHOChina0410.HK3.2Neutral4.57(HK$)4.42-3%6.31(28)4.293.5153.213.07.29.417%1.51.21.11.02.54.95.25.0Simpleaverage10%(33)26.222.912.510.948%2.01.91.61.31.51.72.12.4A/B-sharelistedChinaMerchantsProperty(A)000024.SZ6.3Neutral25.20(Rmb)26.164%37.37(33)22.2018.9035.324.618.216.223%2.92.62.32.10.40.40.60.6ChinaVanke(A)000002.SZ15.7Buy9.77(Rmb)12.1224%13.46(27)8.135.7326.620.213.511.135%3.42.92.42.00.50.71.11.3ChinaVanke(B)200002.SZ1.8Buy9.18(HK$)10.9619%15.65(41)9.456.6622.316.911.19.135%2.82.42.01.70.60.91.31.6ChinaWorldTradeCenter600007.SS1.8Sell11.90(Rmb)8.45-29%13.64(1)7.886.0633.841.4108.267.9-22%2.82.72.72.61.31.20.30.4FinancialStreet000402.SZ4.2Neutral11.56(Rmb)12.206%15.25(24)11.639.2026.418.014.613.317%2.01.81.71.51.31.72.12.3Huafa600325.SS2.1Neutral17.41(Rmb)18.003%25.72(32)12.229.4921.820.917.114.421%3.22.82.52.20.60.61.21.4GemdaleCorp.600383.SS5.3Buy14.52(Rmb)17.4520%21.81(33)10.337.0337.720.315.812.826%3.42.42.11.90.50.70.91.1OverseasChineseTown000069.SZ7.6Neutral16.79(Rmb)18.8112%23.51(29)13.6010.7036.727.620.516.529%5.54.84.13.50.60.91.21.5PolyRealEstate600048.SS11.0Buy21.44(Rmb)25.5119%28.34(24)16.009.1530.521.416.513.227%4.93.02.62.30.50.51.21.5Simpleaverage9%(27)30.123.526.219.421%3.42.82.52.20.70.81.11.3SingaporelistedYanlordYNLG.SI3.2Buy1.94(S$)2.3019%2.88(33)1.651.1623.018.314.211.626%1.91.61.41.30.60.90.81.0USlistedE-HouseEJ1.6Buy20.12(US$)23.9019%NANA15.829.0536.616.014.010.623%4.11.91.71.60.01.21.01.5IFMInvestmentCTC0.3Neutral7.13(US$)8.3417%NANA6.243.96(5.7)16.710.16.458%3.42.21.61.30.00.00.00.0Simpleaverageofabove11%(31)26.622.516.813.438%2.52.21.81.61.11.31.61.9Off-shoreaverage12%(33)25.022.012.610.746%2.11.91.61.41.31.61.82.2On-shoreaverage9%(27)30.123.526.219.421%3.42.82.52.20.70.81.11.3Note:1)*IndicatesthestockisonourConvictionList.2)Our12-monthtargetpricesarebasedonend-2010ENAVfordevelopersandPEmultipleforE-HouseandIFMInvestment.Formethodologyandspecificrisksassociatedwithourpricetargets,pleaseseeourpreviouslypublishedresearch.3)Base-case:5-10%yoypriceincreasein2010fromaverage2009orabout10%declinefromDec09.10%p.a.priceincreasein2011and2012andflatafterwards;15%volumedecreasedin2010from2009level.Bear-case:30%reductioninpropertypricefromcurrentlevelsand35%fallinvolumeover2009;Worst-case:45%pricefallfromcurrentlevelsanda35%fallinvolume.4)Forimportantdisclosures,pleasegotohttp://www.gs.com/research/hedge.html.Source:DataStream,companydata,GaoHuaSecuritiesResearchestimates.GaoHuaSecuritiesInvestmentResearch6

April6,2010China:RealEstateDevelopersRegACI,JasonSun,herebycertifythatalloftheviewsexpressedinthisreportaccuratelyreflectmypersonalviewsaboutthesubjectcompanyorcompaniesanditsortheirsecurities.Ialsocertifythatnopartofmycompensationwas,isorwillbe,directlyorindirectly,relatedtothespecificrecommendationsorviewsexpressedinthisreport.InvestmentProfileTheInvestmentProfileprovidesinvestmentcontextforasecuritybycomparingkeyattributesofthatsecuritytoitspeergroupandmarket.Thefourkeyattributesdepictedare:growth,returns,multipleandvolatility.Growth,returnsandmultipleareindexedbasedoncompositesofseveralmethodologiestodeterminethestockspercentilerankingwithintheregion"scoverageuniverse.Theprecisecalculationofeachmetricmayvarydependingonthefiscalyear,industryandregionbutthestandardapproachisasfollows:Growthisacompositeofnextyear"sestimateovercurrentyear"sestimate,e.g.EPS,EBITDA,Revenue.Returnisayearoneprospectiveaggregateofvariousreturnoncapitalmeasures,e.g.CROCI,ROACE,andROE.Multipleisacompositeofone-yearforwardvaluationratios,e.g.P/E,dividendyield,EV/FCF,EV/EBITDA,EV/DACF,Price/Book.Volatilityismeasuredastrailingtwelve-monthvolatilityadjustedfordividends.QuantumQuantumisGoldmanSachs"proprietarydatabaseprovidingaccesstodetailedfinancialstatementhistories,forecastsandratios.Itcanbeusedforin-depthanalysisofasinglecompany,ortomakecomparisonsbetweencompaniesindifferentsectorsandmarkets.DisclosuresCoveragegroup(s)ofstocksbyprimaryanalyst(s)JasonSun:ChinaProperty.ChinaProperty:AgilePropertyHoldings,ChinaMerchantsProperty(A),ChinaOverseasLand,ChinaResourcesLand,ChinaVanke(A),ChinaVanke(B),ChinaWorldTradeCenter,CountryGardenHoldingsCompany,E-House(China)HoldingsLimited,EvergrandeRealEstateGroup,FantasiaHoldingGroupCo.,FinancialStreetHoldingCo,FranshionProperties(China),GemdaleCorp,GreentownChinaHoldings,GuangzhouR&FProperties,HuafaIndustrial,IFMInvestments,KWGPropertyHolding,PolyRealEstateGroup,PowerlongRealEstateHoldings,ShanghaiForteLand,ShenzhenInvestment,ShenzhenOverseasChineseTownHolding,ShimaoProperty,ShuiOnLand,Sino-OceanLandHoldings,SOHOChina,YanlordLand.Company-specificregulatorydisclosuresThefollowingdisclosuresrelatetorelationshipsbetweenGoldmanSachsGaoHuaSecuritiesCompanyLimited("GoldmanSachsGaoHua")andcompaniescoveredbytheInvestmentResearchDivisionofBeijingGaoHuaSecuritiesCompanyLimited("GaoHuaSecurities")andreferredtointhisresearch.Therearenocompany-specificdisclosures.Ratings,coveragegroupsandviewsandrelateddefinitionsBuy(B),Neutral(N),Sell(S)-AnalystsrecommendstocksasBuysorSellsforinclusiononvariousregionalInvestmentLists.BeingassignedaBuyorSellonanInvestmentListisdeterminedbyastock"sreturnpotentialrelativetoitscoveragegroupasdescribedbelow.AnystocknotassignedasaBuyoraSellonanInvestmentListisdeemedNeutral.EachregionalInvestmentReviewCommitteemanagesvariousregionalInvestmentListstoaglobalguidelineof25%-35%ofstocksasBuyand10%-15%ofstocksasSell;however,thedistributionofBuysandSellsinanyparticularcoveragegroupmayvaryasdeterminedbytheregionalInvestmentReviewCommittee.RegionalConvictionBuyandSelllistsrepresentinvestmentrecommendationsfocusedoneitherthesizeofthepotentialreturnorthelikelihoodoftherealizationofthereturn.Returnpotentialrepresentsthepricedifferentialbetweenthecurrentsharepriceandthepricetargetexpectedduringthetimehorizonassociatedwiththepricetarget.Pricetargetsarerequiredforallcoveredstocks.Thereturnpotential,pricetargetandassociatedtimehorizonarestatedineachreportaddingorreiteratinganInvestmentListmembership.Coveragegroupsandviews:Alistofallstocksineachcoveragegroupisavailablebyprimaryanalyst,stockandcoveragegroupathttp://www.gs.com/research/hedge.html.Theanalystassignsoneofthefollowingcoverageviewswhichrepresentstheanalyst"sinvestmentoutlookonthecoveragegrouprelativetothegroup"shistoricalfundamentalsand/orvaluation.Attractive(A).Theinvestmentoutlookoverthefollowing12monthsisfavorablerelativetothecoveragegroup"shistoricalfundamentalsand/orvaluation.Neutral(N).Theinvestmentoutlookoverthefollowing12monthsisneutralrelativetothecoveragegroup"shistoricalfundamentalsand/orvaluation.Cautious(C).TheinvestmentGaoHuaSecuritiesInvestmentResearch6

April6,2010China:RealEstateDevelopersoutlookoverthefollowing12monthsisunfavorablerelativetothecoveragegroup"shistoricalfundamentalsand/orvaluation.GaoHuaSecuritiesInvestmentResearch6

April6,2010China:RealEstateDevelopersNotRated(NR).TheinvestmentratingandtargetpricehavebeenremovedpursuanttoGaoHuaSecuritiespolicywhenGoldmanSachsGaoHuaisactinginanadvisorycapacityinamergerorstrategictransactioninvolvingthiscompanyandincertainothercircumstances.RatingSuspended(RS).Wehavesuspendedtheinvestmentratingandpricetargetforthisstock,becausethereisnotasufficientfundamentalbasisfordetermininganinvestmentratingortarget.Thepreviousinvestmentratingandpricetarget,ifany,arenolongerineffectforthisstockandshouldnotbereliedupon.CoverageSuspended(CS).Wehavesuspendedcoverageofthiscompany.NotCovered(NC).Wedonotcoverthiscompany.NotAvailableorNotApplicable(NA).Theinformationisnotavailablefordisplayorisnotapplicable.NotMeaningful(NM).Theinformationisnotmeaningfulandisthereforeexcluded.GeneraldisclosuresThisresearchisdisseminatedinChinabyGaoHuaSecurities.Thisresearchisforourclientsonly.Thisresearchisbasedoncurrentpublicinformationthatweconsiderreliable,butwedonotrepresentitisaccurateorcomplete,anditshouldnotbereliedonassuch.Weseektoupdateourresearchasappropriate,butvariousregulationsmaypreventusfromdoingso.Otherthancertainindustryreportspublishedonaperiodicbasis,thelargemajorityofreportsarepublishedatirregularintervalsasappropriateintheanalyst"sjudgment.GoldmanSachsGaoHua,anaffiliateofGaoHuaSecurities,conductsaninvestmentbankingbusiness.GaoHuaSecurities,GoldmanSachsGaoHuaandtheiraffiliateshaveinvestmentbankingandotherbusinessrelationshipswithasubstantialpercentageofthecompaniesreferredtointhisdocument.Oursalespeople,traders,andotherprofessionalsmayprovideoralorwrittenmarketcommentaryortradingstrategiestoourclientsandourproprietarytradingdesksthatreflectopinionsthatarecontrarytotheopinionsexpressedinthisresearch.Ourproprietarytradingdesksandinvestingbusinessesmaymakeinvestmentdecisionsthatareinconsistentwiththerecommendationsorviewsexpressedinthisresearch.GaoHuaSecuritiesanditsaffiliates,officers,directors,andemployees,excludingequityandcreditanalysts,willfromtimetotimehavelongorshortpositionsin,actasprincipalin,andbuyorsell,thesecuritiesorderivatives,ifany,referredtointhisresearch.Thisresearchisnotanoffertosellorthesolicitationofanoffertobuyanysecurityinanyjurisdictionwheresuchanofferorsolicitationwouldbeillegal.Itdoesnotconstituteapersonalrecommendationortakeintoaccounttheparticularinvestmentobjectives,financialsituations,orneedsofindividualclients.Clientsshouldconsiderwhetheranyadviceorrecommendationinthisresearchissuitablefortheirparticularcircumstancesand,ifappropriate,seekprofessionaladvice,includingtaxadvice.Thepriceandvalueofinvestmentsreferredtointhisresearchandtheincomefromthemmayfluctuate.Pastperformanceisnotaguidetofutureperformance,futurereturnsarenotguaranteed,andalossoforiginalcapitalmayoccur.Fluctuationsinexchangeratescouldhaveadverseeffectsonthevalueorpriceof,orincomederivedfrom,certaininvestments.Certaintransactions,includingthoseinvolvingfutures,options,andotherderivatives,giverisetosubstantialriskandarenotsuitableforallinvestors.InvestorsshouldreviewcurrentoptionsdisclosuredocumentswhichareavailablefromGaoHuasalesrepresentativesorathttp://www.theocc.com/publications/risks/riskchap1.jsp.Transactionscostmaybesignificantinoptionstrategiescallingformultiplepurchaseandsalesofoptionssuchasspreads.Supportingdocumentationwillbesupplieduponrequest.Copyright2010BeijingGaoHuaSecuritiesCompanyLimitedNopartofthismaterialmaybe(i)copied,photocopiedorduplicatedinanyformbyanymeansor(ii)redistributedwithoutthepriorwrittenconsentofBeijingGaoHuaSecuritiesCompanyLimited.GaoHuaSecuritiesInvestmentResearch6'

您可能关注的文档

- 2014-2018年中国商铺地产行业发展前景分析和投资风险预测

- 2011年中国工业地产行业发展前景预测报告

- 论文:北京房地产行业发展现状分析及07年趋势预测

- 两会闭幕后房地产行业发展状况研究

- 浅谈两会闭幕后房地产行业发展状况

- 全国房地产行业发展分析项目可行性研究报告

- 高盛年中国房地产行业发展报告

- 我国房地产行业发展现状

- 2010-2015年无锡房地产行业发展前景分析及投资风险预测

- 银行对房地产行业发展状况的调查报告

- 中国房地产行业发展趋势预测及投资战略研究报告.doc

- 2016-202011年中国商铺地产行业发展预测与投资战略规划分析报告.docx

- 2017-2022年中国东莞房地产行业发展预测及投资咨询研究报告行业发展预测.docx

- 2017年中国商业地产行业发展格局及投资方向研究报告.doc

- 2017-202011年济南房地产行业发展预测分析及投资咨询报告.docx

- 2017-202011年济南房地产行业发展预测分析及投资咨询报告-行业趋势研究预测报告.docx

- 中国商业地产行业发展趋势与投资决策分析报告2018年版.docx

- 2016-202011年中国房地产行业发展趋势及竞争策略研究报告.doc